ct sales tax online

Connecticut State Department of Revenue Services. This webpage contains copies of public notices issued by certain Connecticut municipalities relating to auctions they have slated to collect unpaid taxes and other charges under Connecticut General Statutes 12-157.

Now you can file tax returns make payments and view your filing history in one location.

. Creating your myconneCT username Obtain your Connecticut Registration Number or Federal Employer Identification Number FEIN legal business name and PIN from TSC. Connecticut passed legislation in 2011 enacting what is known as a Amazon law which requires e-commerce enterprises having marketing affiliates in the state to collect and remit sales tax. Just enter the five-digit zip code of the.

You need your Connecticut Tax Registration Number or Federal Employer Identification Number FEIN legal business name for sole proprietors. The statewide rate of 635 applies to the retail sale lease or rental of most goods and taxable services. You should have received credentials to access your Connecticut Taxpayer Service Center account when you applied for your Connecticut sales tax license.

Scroll to view the full table and click any category for more details. Child Tax Rebate - A new child tax rebate was recently authorized by the Connecticut General Assembly. City Total Sales Tax Rate.

Gas Tax - For updated information on the. There are no additional sales taxes imposed by local jurisdictions in Connecticut. Create a Business Account Tax Preparer Account.

The current state sales tax rate in Connecticut CT is 635 percent. The Department of Revenue Services will be closed on Monday July 4 2022 a state holiday. Amston CT Sales Tax Rate.

Connecticut State Sales Tax. Maximum Possible Sales Tax. Your business has sales tax nexus in the same state as your customer.

Sales and Use Business Use Withholding Room Occupancy BB Occupancy Prepaid Wireless E 9-1-1 Fee Admissions and Dues. Since municipalities and their attorneys cannot. The product is taxable in that state.

Your last name and TSC PIN number. This search covers all domestic formed in Connecticut and foreign formed outside of Connecticut entities on record. Ansonia CT Sales Tax Rate.

The Connecticut state sales tax rate is 635. The same goes if you have nexus in Connecticut because you sell on FBA. Enter business name business ALEI or filing number.

There are no local sales tax rates which means that collecting sales tax is easy. The Department of Revenue Services to hold Live Virtual Event about. Sales Tax Rates There is only one statewide sales and use tax.

Sales tax nexus is just a fancy legalese way to say significant connection to a state. In July 2011 Connecticut increased its sales and use tax rate to 635 percent. No matter if you live in Connecticut or out of state charge a flat 635 in sales tax to your customers in Connecticut.

The Department of Revenue Services to hold Live Virtual Event about the 2022 Child Tax Rebate on July 7 2022 Click here to learn more. Returning Users Login Username Forgot UserName. Usually the vendor collects the sales tax from the consumer as the consumer makes a purchase.

The Department of Revenue Services will be closed on Monday July 4 2022 a state holiday. Maximum Local Sales Tax. Businesses and Bulk Filers can now begin using the agencys new online portal to register file tax returns make payments and view filing history.

Looking for something specific. Andover CT Sales Tax Rate. If you are interested in the sales tax on vehicle sales see the car sales tax page instead.

However there are exceptions. First time using myconneCT. You can process your required sales tax filings and payments online using the official Connecticut Taxpayer Service Center website which can be found here.

Disclaimer This webpage and its contents are for general informational use only and are not legal advice. See notes in category taxability page for details Back to Connecticut Sales Tax Handbook Top. The basic rule for online sellers when collecting sales tax is.

Abington CT Sales Tax Rate. Learn about compliance with a free guide from Avalara. Child Tax Rebate - A new child tax rebate was recently authorized by the Connecticut General Assembly.

Visit myconneCT now to file pay and manage the following tax types. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. CT Child Tax Rebate Click here for rebate eligibility requirements and latest updates.

Department of Revenue Services. The Connecticut state sales tax rate is 635 and the average CT sales tax after local surtaxes is 635. A sales tax is a consumption tax paid to a government on the sale of certain goods and services.

To get started with myconneCT click here. In most countries the sales tax is called value-added tax VAT or goods and services tax GST which is a different form of consumption tax. Groceries prescription drugs and non-prescription drugs are exempt from the Connecticut sales tax Counties and cities are not allowed to collect local sales taxes.

Lets explore these concepts a bit more in-depth. STO - Home A cloud-based solution to file and remit tax returns. Remember Username Business Account For business owners or companies who need to file for a single business or a business with multiple locations.

This table shows the taxability of various goods and services in Connecticut. You can obtain all of this information from inside TSC. MyconneCT is the new online hub for business tax needs.

A tax at the general rate of 635 is imposed by the state on most sales of tangible personal property and on most services enumerated in Section 12-407 of the Connecticut General Statutes. Click here to File Pay or Register Now on myconneCT. Get the free Avalara guide for ecommerce sales tax compliance.

Average Local State Sales Tax. Connecticut has a 635 statewide sales tax rate and does not allow local governments to collect sales taxes. Ad Ecommerce sales tax can be tricky.

States With Highest And Lowest Sales Tax Rates

Taxjar State Sales Tax Calculator Sales Tax Tax Nexus

Connecticut Department Of Revenue Services

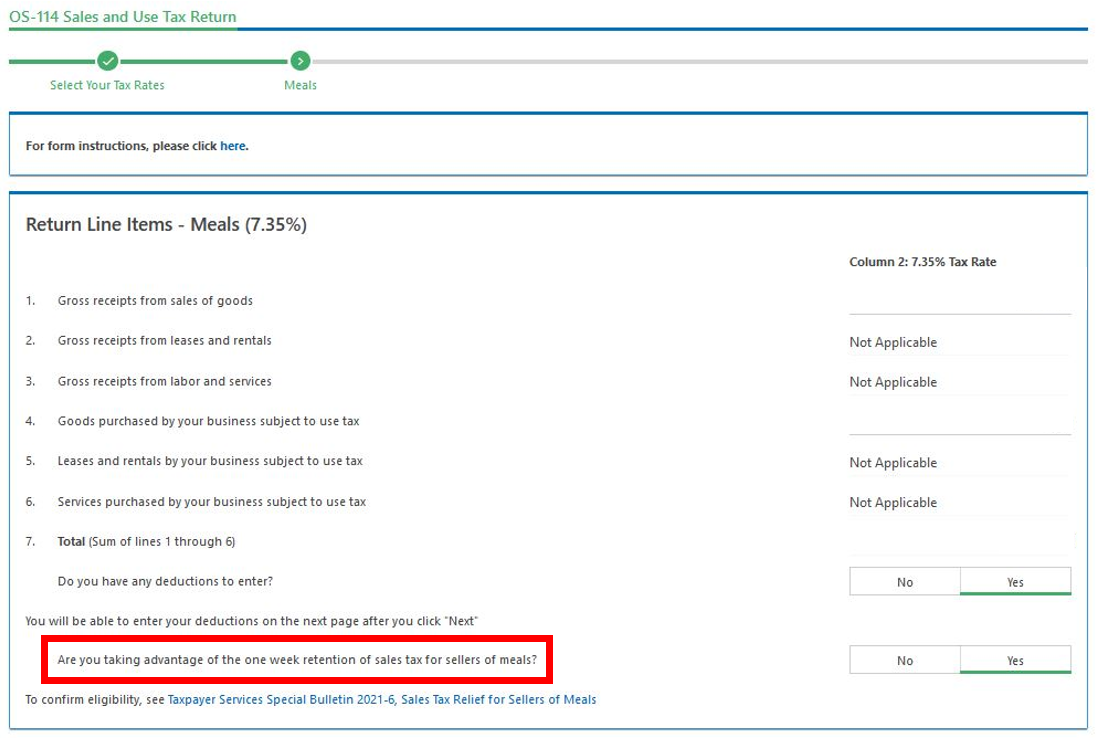

Sales Tax Relief For Sellers Of Meals

Llc In Ct How To Start An Llc In Connecticut Truic

Connecticut Department Of Revenue Services

How To File Sales Tax In Each State Taxjar

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Sales Tax By State Is Saas Taxable Taxjar

How To Calculate Sales Tax For Your Online Store

Do You Have To Pay Sales Tax On Internet Purchases Findlaw

Learn More From Our Online Sales Tax Guide For Ecommerce

Connecticut Sales Tax Guide And Calculator 2022 Taxjar

Connecticut Department Of Revenue Services

How Do State And Local Sales Taxes Work Tax Policy Center

Where S My State Refund Track Your Refund In Every State